43 yield to maturity coupon bond

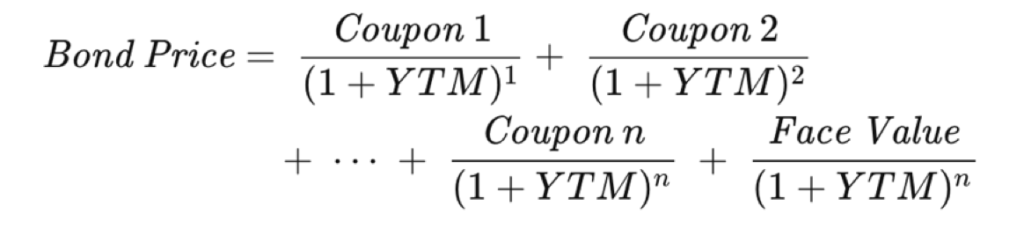

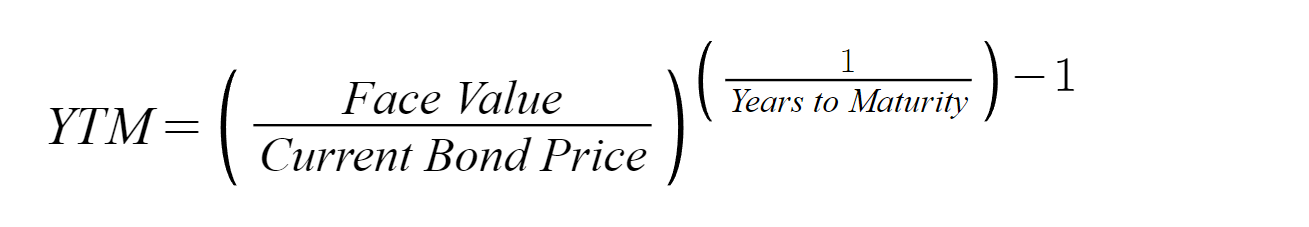

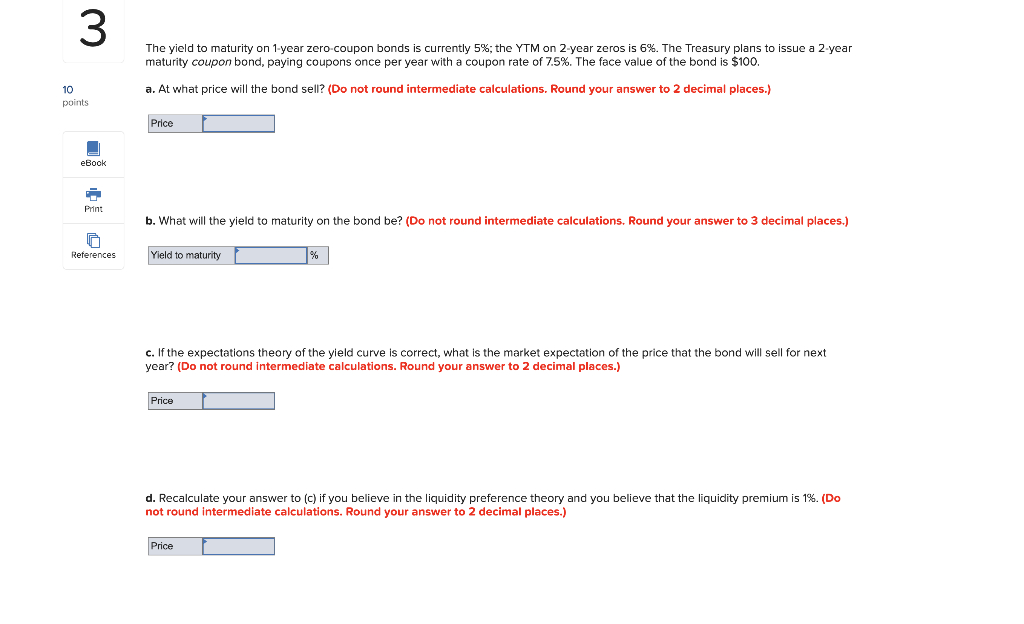

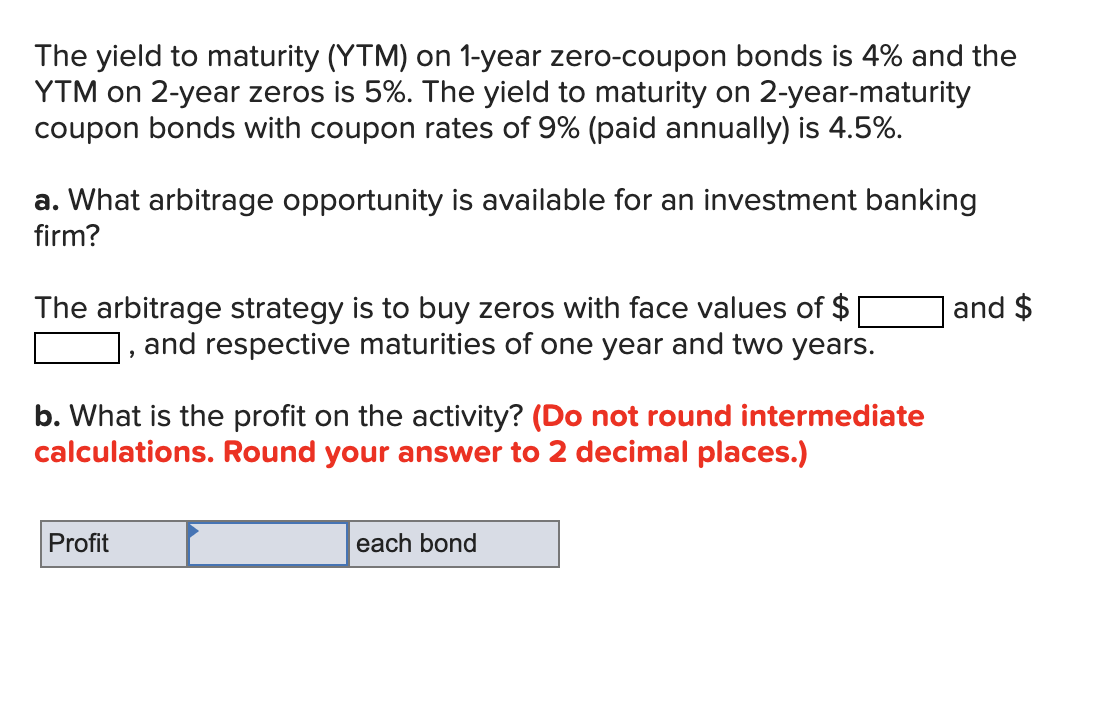

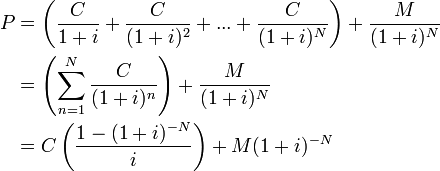

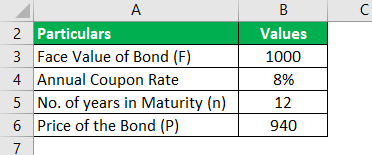

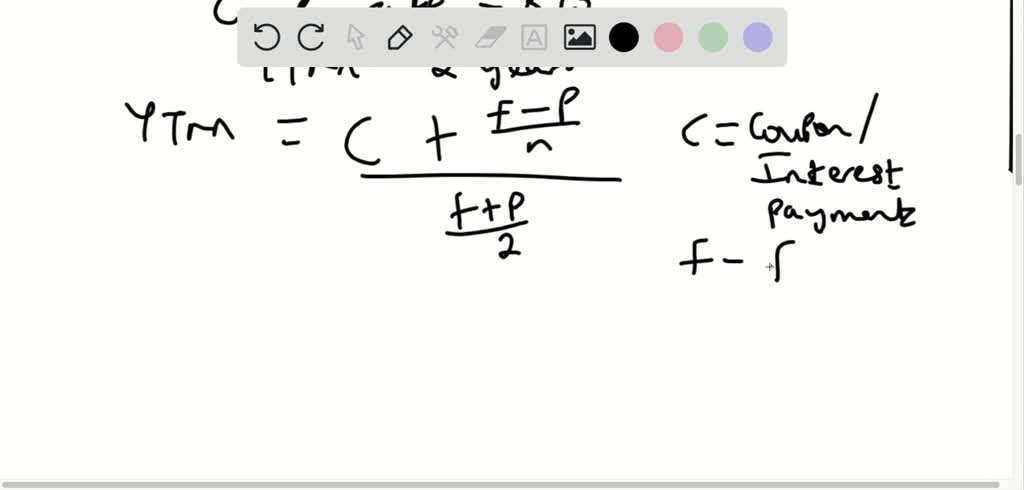

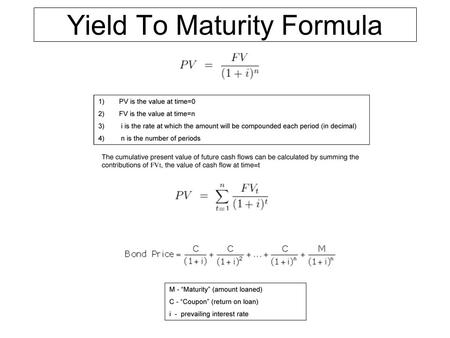

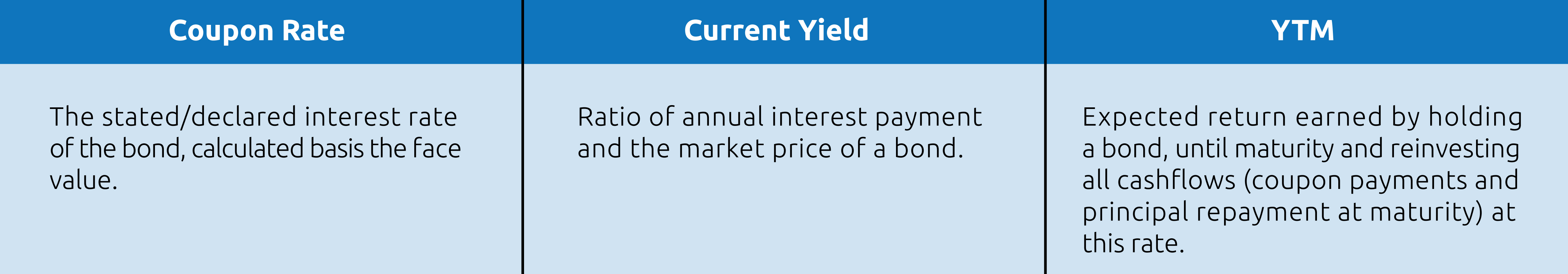

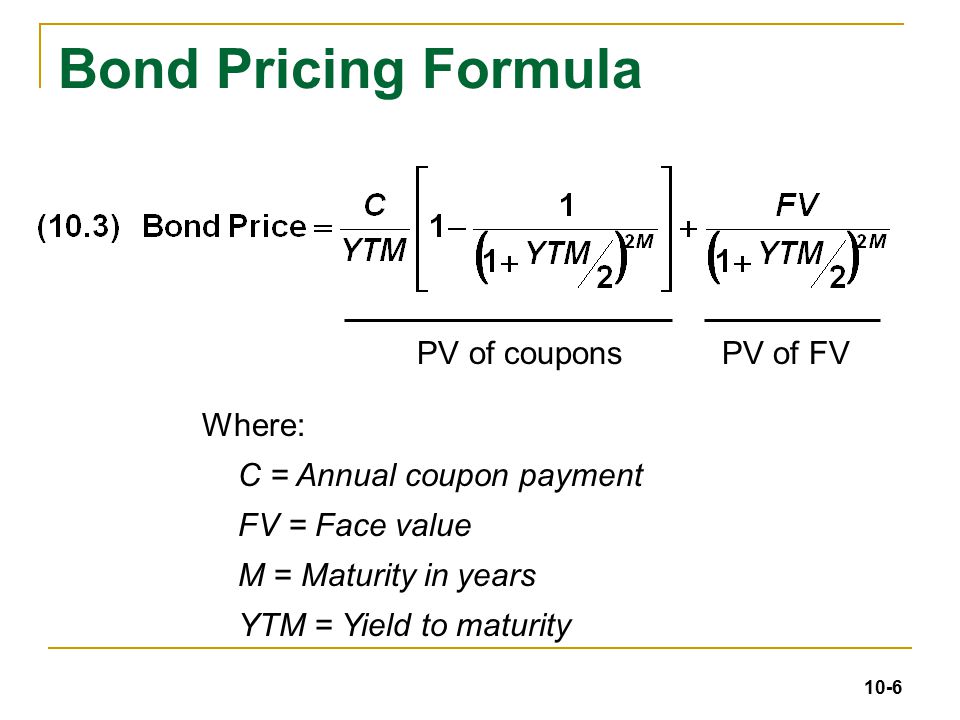

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · A bond's yield to maturity is based on the interest rate the investor would earn from reinvesting every coupon payment. The coupons would be reinvested at an average interest rate until the bond ... Yield to Maturity Calculator | YTM Calculator The yield to maturity is the annualized rate of return using any appreciation or depreciation from the bond, as well as annual coupon payments. Total Coupon Cash Flow: The total cash flow from the interest or coupon payments received by the investor over the "years to maturity."

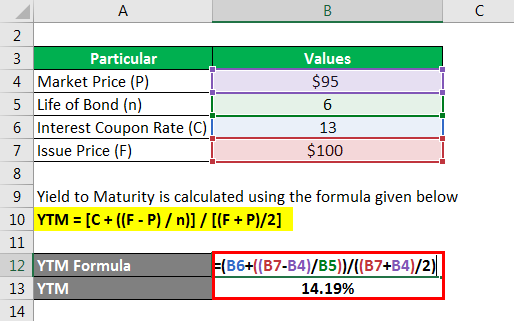

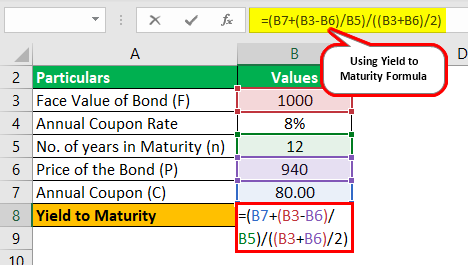

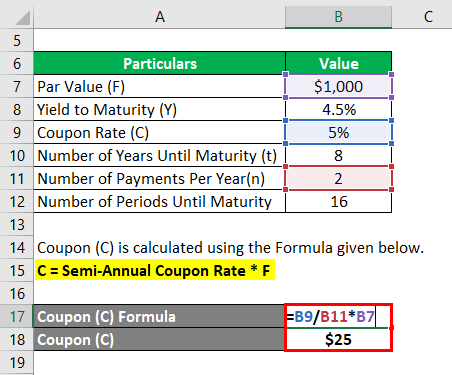

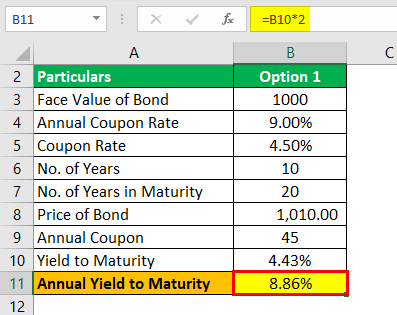

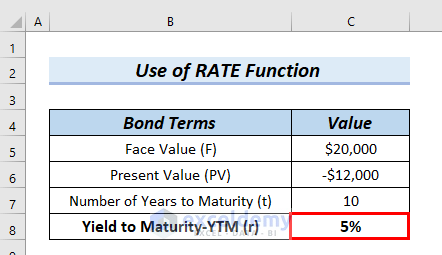

How to Calculate Bond Yield in Excel: 7 Steps (with Pictures) Mar 29, 2019 · The Yield to Maturity should read 6.0%, and the Yield to Call should read 9.90%. If the values in the bond yield calculator match the figures listed above, the formulas have been entered correctly. If the values do not match, double check that the formulas have been entered correctly.

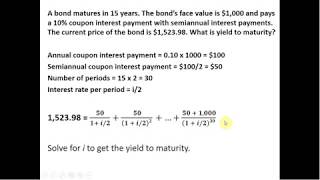

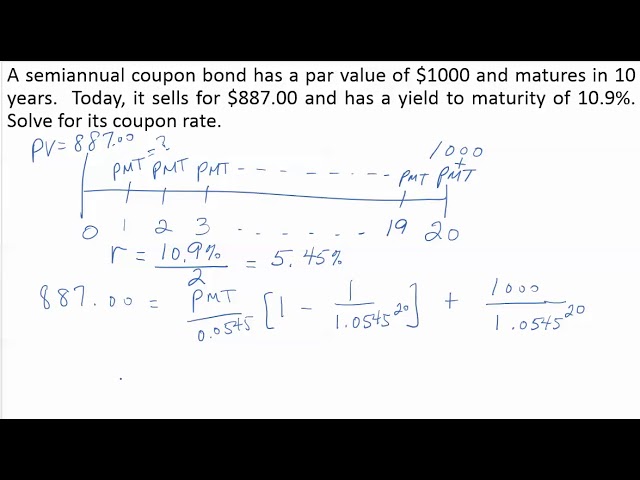

Yield to maturity coupon bond

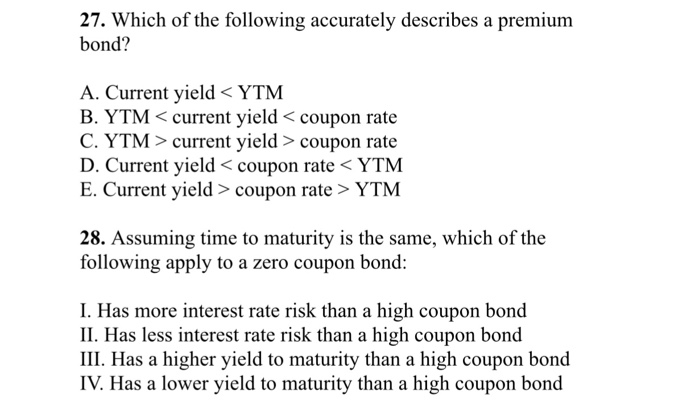

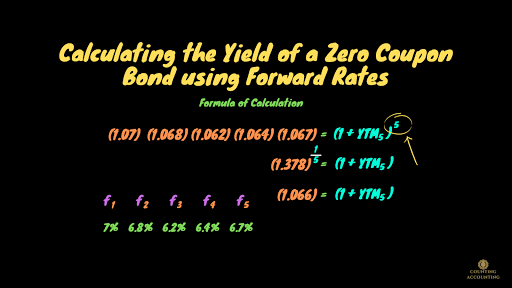

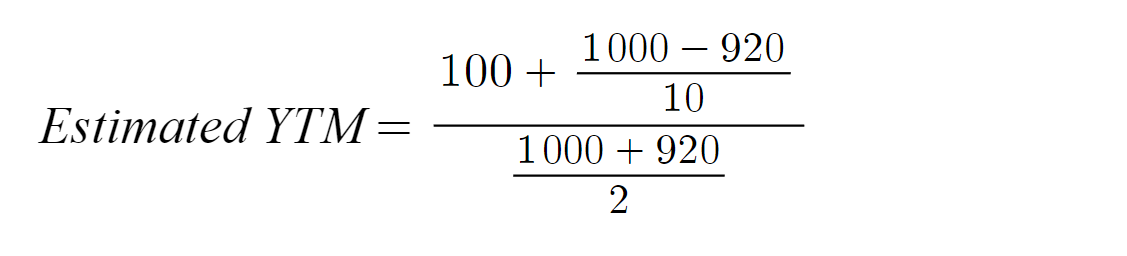

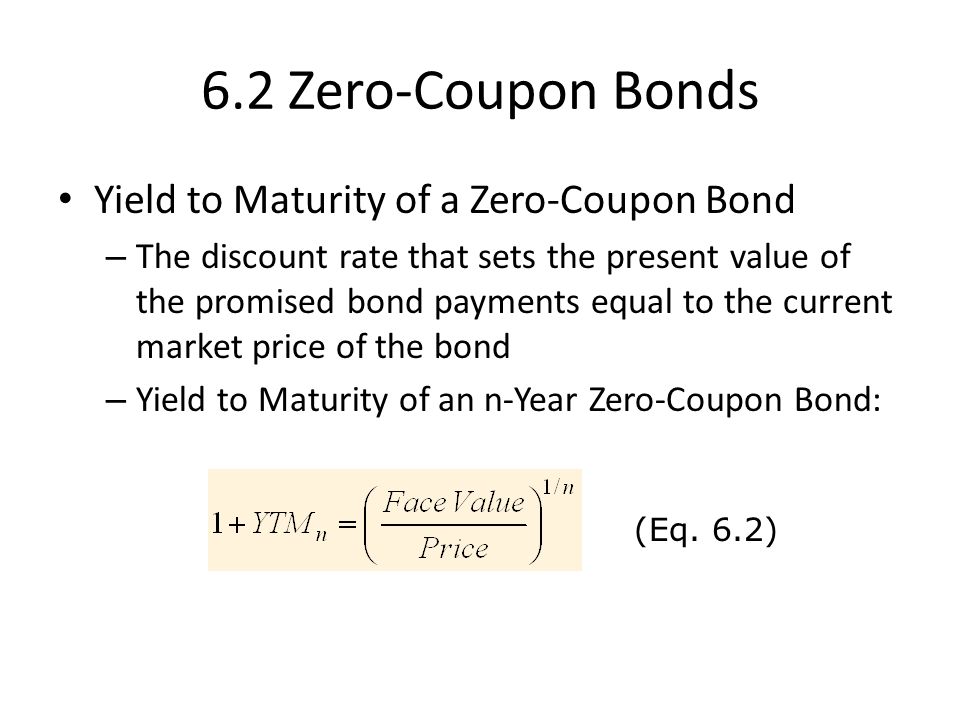

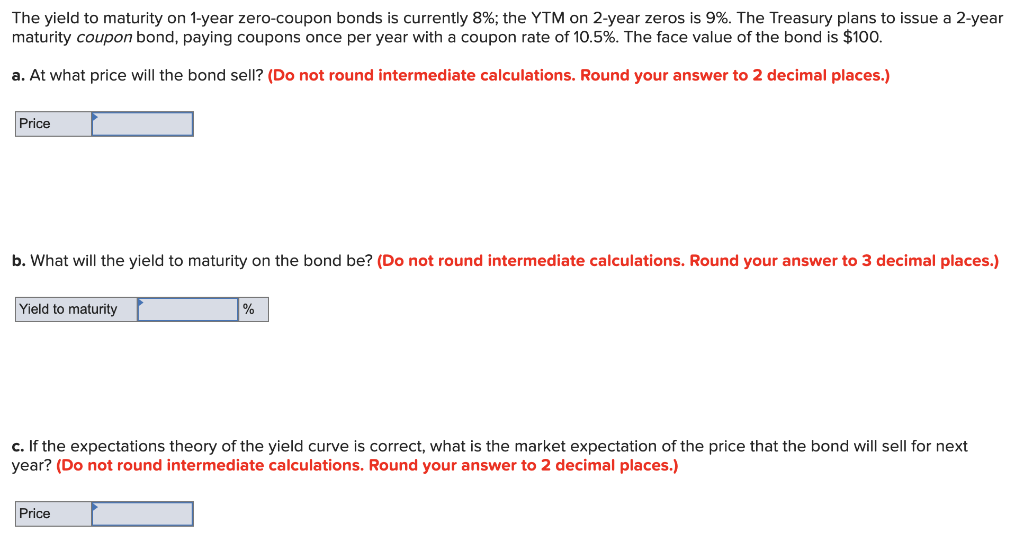

Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date. What Is a Negative Bond Yield? - Investopedia Nov 27, 2020 · Negative Bond Yield: A negative bond yield is an unusual situation in which issuers of debt are paid to borrow. At the same time, depositors, or buyers of bonds, pay a cash flow instead of ...

Yield to maturity coupon bond. Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · Bond Prices and Yields: An Overview . If you buy a bond at issuance, the bond price is the face value of the bond, and the yield will match the coupon rate of the bond. What Is a Negative Bond Yield? - Investopedia Nov 27, 2020 · Negative Bond Yield: A negative bond yield is an unusual situation in which issuers of debt are paid to borrow. At the same time, depositors, or buyers of bonds, pay a cash flow instead of ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) May 06, 2021 · Learn the variations of yield to maturity. Bond issuers may not choose to allow a bond to grow until maturity. These actions decrease the yield on a bond. They may call a bond, which means redeeming it before it matures. Or, they may put it, which means that the issuer repurchases the bond before its maturity date. Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds

:max_bytes(150000):strip_icc()/terms_b_bond-yield_FINAL-3ab7b1c73e8b487a9e860f0a5ca6dd6b.jpg)

Post a Comment for "43 yield to maturity coupon bond"