38 coupon rate bond calculator

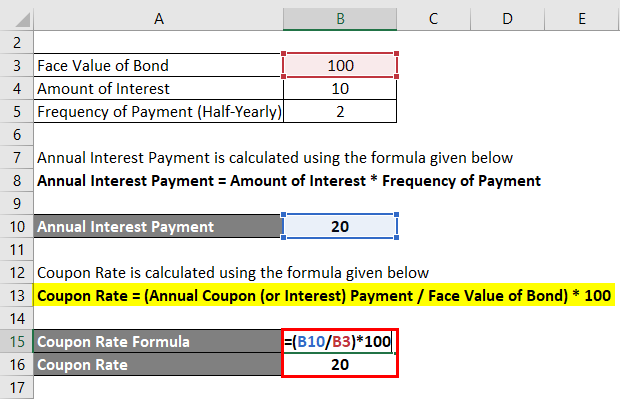

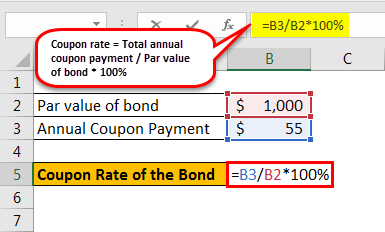

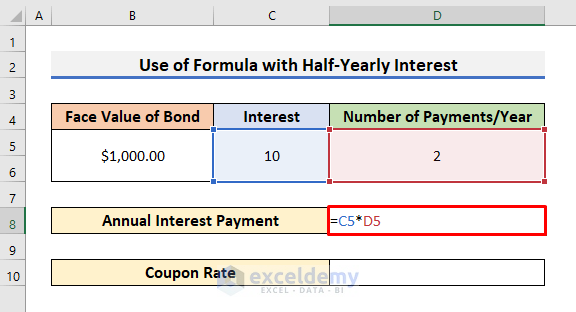

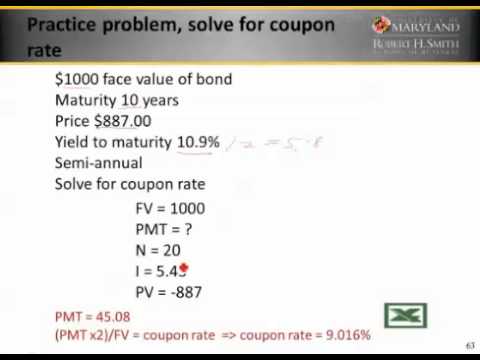

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then dividing that by the face value (or “par ... Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ...

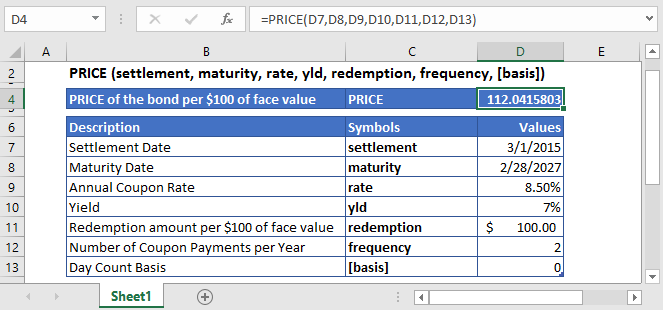

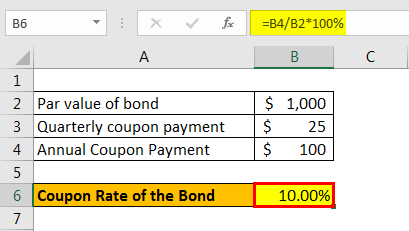

Coupon Rate: Formula and Bond Calculation - Wall Street Prep The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond.

Coupon rate bond calculator

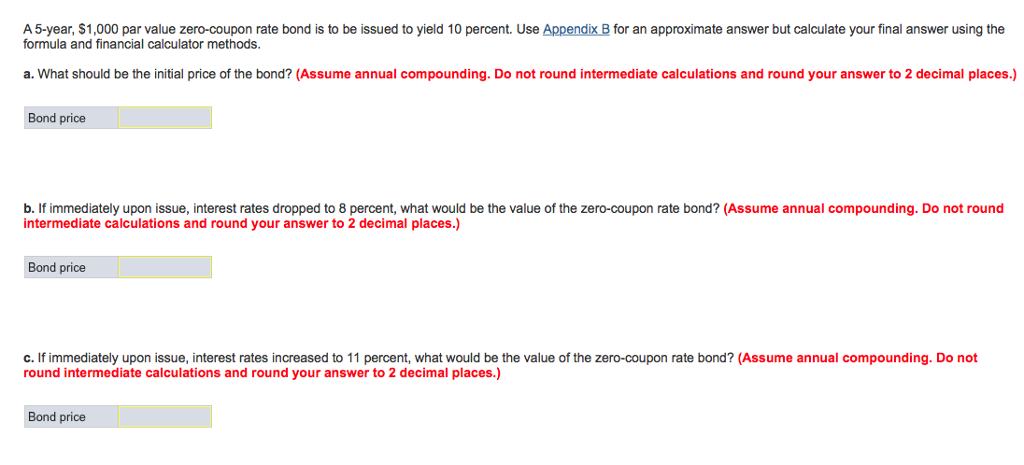

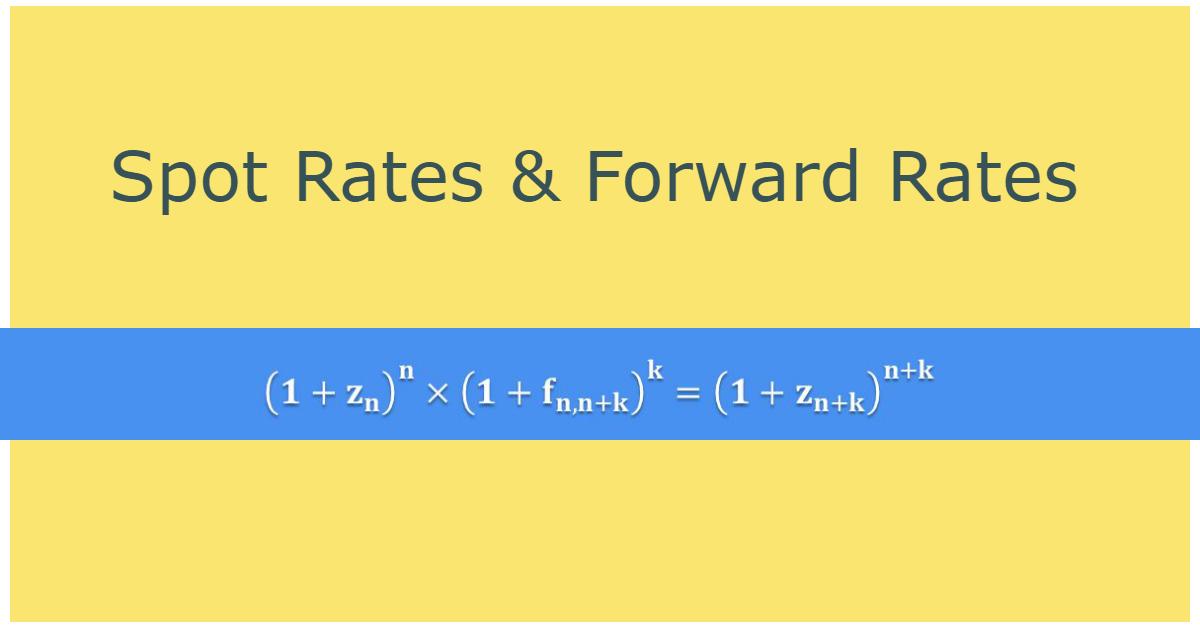

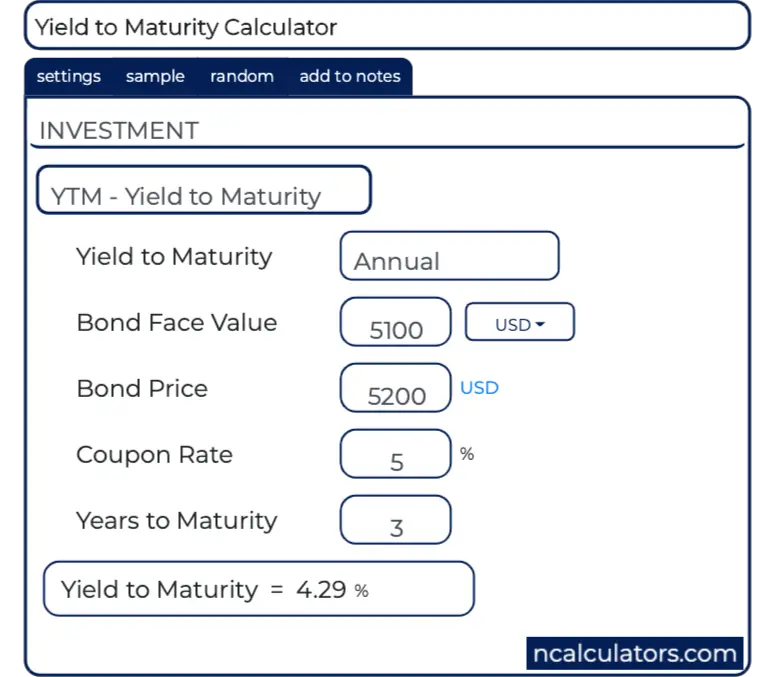

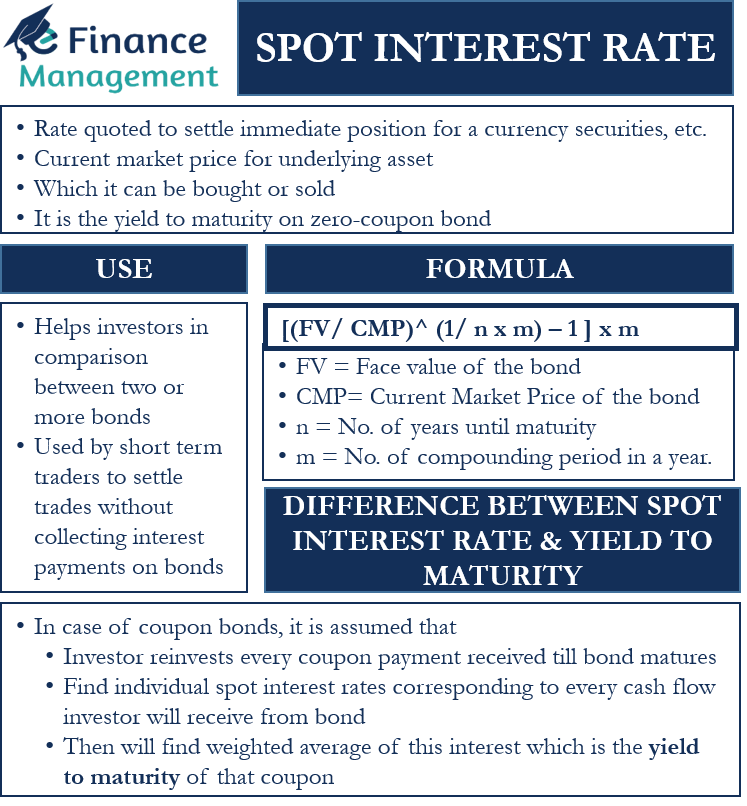

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Bond Present Value Calculator - BuyUpside.com Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or ... Zero-Coupon Bonds: Characteristics and Calculation Example In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV).

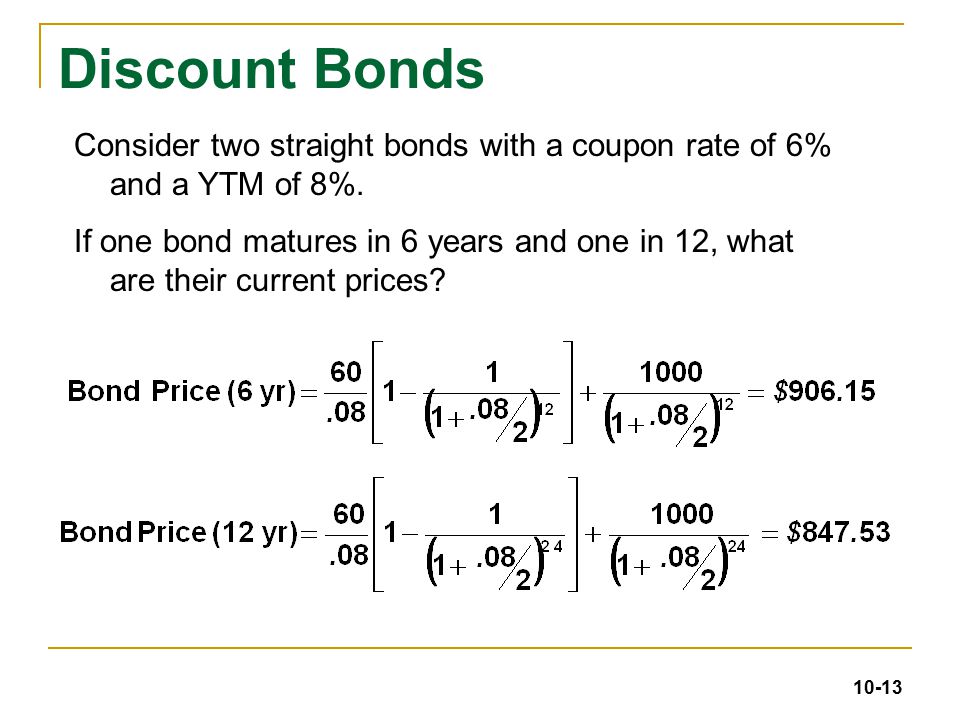

Coupon rate bond calculator. Bond Valuation Calculator - RR Investor It is assumed that all bonds pay interest "Semi-Annually". Instructions: Fill in the spaces that correspond to the number of years, maturity, coupon rate, and ... Coupon Rate Calculator - EasyCalculation Here is a simple online calculator to calculate the coupon percentage rate ... The term coupon refers to a value which is affixed to bond certificates and ... Bond Valuation Calculator | Calculate Bond Valuation Bond Valuation Definition. Our free online Bond Valuation Calculator makes it easy to calculate the market value of a bond. To use our free Bond Valuation Calculator just enter in the bond face value, months until the bonds maturity date, the bond coupon rate percentage, the current market rate percentage (discount rate), and then press the calculate button. Bond Calculator - Financial Calculators Bond Calculator. Bond Price. Face Value. Annual Coupon Payment. Annual Yield (%). Years to Maturity. Or Enter Maturity Date. Compounding.

Bond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas. What Is a Bond Coupon? - The Balance Mar 04, 2021 · "Bond coupons" is a term that's used to refer to physical coupons. These coupons could be redeemed for cash. The term is another way of referring to a bond's interest payment in 2022 and when it will be due. The bond coupon may not match the actual interest payments on the secondary market. Ups and downs in bond price will change the interest ... Bond Duration Calculator - Exploring Finance C = Coupon rate = 6% or 0.06 Additionally, since the bond matures in 2 years, then for a semiannual bond, you'll have a total of 4 coupon payments (one payment every 6 months), such that: t 1 = 0.5 years Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the coupon rate of the bond (only numeric characters 0-9 and a decimal point, no percent sign). The coupon rate is the annual interest the bond pays. If a bond with a par value of $1,000 is paying you $80 per year, then the coupon rate would be 8% (80 ÷ 1000 = .08, or 8%).

Bond Price Calculator - Belonging Wealth Management If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is ... Bond Calculators - Financial Wisdom Forum You buy a bond, reinvesting coupons at the Yield to Maturity. ... Bond Value = B { 1/(1+R)N + (Cr/R) (1 - (1+R/m)-mN)} ... Annual Coupon Rate: Cr = Zero-Coupon Bonds: Characteristics and Calculation Example In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price. To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). Bond Present Value Calculator - BuyUpside.com Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or ...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond.

Post a Comment for "38 coupon rate bond calculator"