44 coupon rate and yield

Coupon rate definition — AccountingTools A coupon rate is the interest percentage stated on the face of a bond or similar instrument. This is the interest rate that a bond issuer pays to a bond holder, usually at intervals of every six months. The current yield may vary from the coupon rate, depending on the price at which an investor buys a bond. For example, if an investor pays less ... Difference Between Yield & Coupon Rate

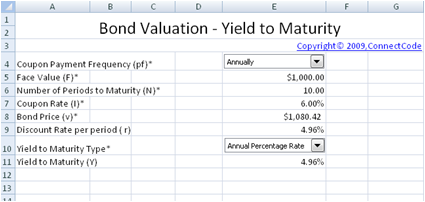

Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Coupon rate and yield

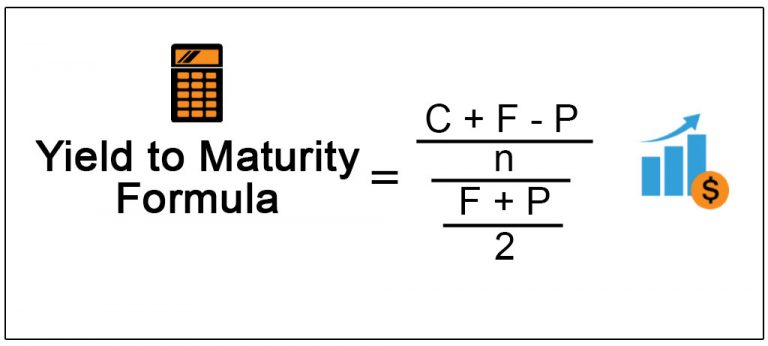

Coupon Rate vs Yield Rate for Bonds | Wall Street Oasis Yield can be different than coupon rates based on the principal price of the bond. If the price is par at time of purchase and you receive par at maturity, then the yield and coupon will be the same. For instance, say a bond at issuance is priced at 100 with 10% coupons. You pay 100 initially and receive 10% coupons over the life of the bond. Coupon vs Yield | Top 8 Useful Differences (with Infographics) Coupon Rate or Nominal Yield = Annual Payments / Face Value of the Bond Current Yield = Annual Payments / Market Value of the Bond Zero-Coupon Bonds are the only bond in which no interim payments occur except at maturity along with its face value. Popular Course in this category Difference between Yield Coupon Rate - Difference Betweenz The yield rate is the annual percentage of return on investment, while the coupon rate is simply the periodic interest payments (coupons) made on a bond or note. When you are looking at investments, it's important to know which one offers you a higher return. However, it's also important to consider other factors such as risk and liquidity.

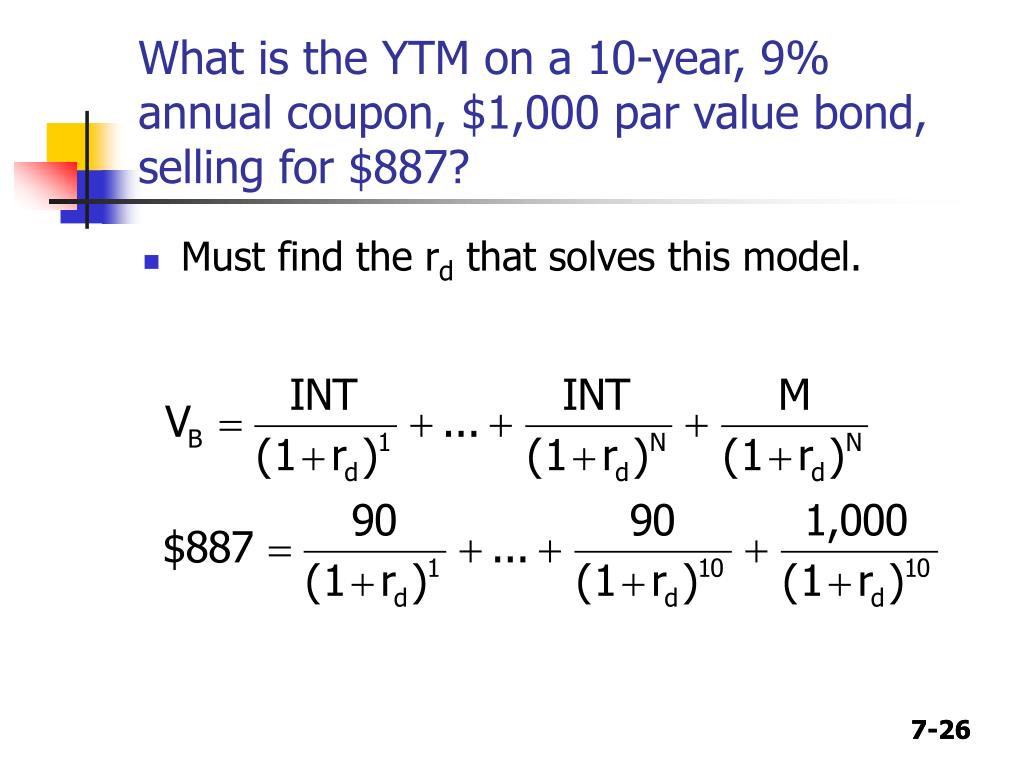

Coupon rate and yield. What Do You Mean By Coupon Rate - WhatisAny The coupon rate is the annual rate of the bond that has to be paid to the holder. What is YTM and coupon rate? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. Difference Between Yield and Coupon A company issues a bond at $1000 par value that has a coupon interest rate of 10%. So to calculate the yield = coupon/price would be (coupon =10% of 1000 = $100), $100/$1000. This bond will carry a yield of 10%. However in a few years' time the bond price will fall to $800. The new yield for the same bond would be ($100/$800) 12.5%. Summary: Yield to Maturity vs. Coupon Rate: What's the Difference? The coupon rate or yield is the amount that investors can expect to receive in income as they hold the bond. Coupon rates are fixed when the government or company issues the bond, although bonds... What Are Coupon and Current Bond Yield All About? Current yield is derived by taking the bond's coupon yield and dividing it by the bond's price. Suppose you had a $1,000 face value bond with a coupon rate of 5 percent, which would equate to $50 a year in your pocket. If the bond sells today for 98 (meaning that it is selling at a discount for $980), the current yield is $50 divided by ...

Coupon vs Yield | Top 5 Differences (with Infographics) coupon refers to the amount which is paid as the return on the investment to the holder of the bond by bond issuer which remains unaffected by the fluctuations in purchase price whereas, yield refers to the interest rate on bond that is calculated on basis of the coupon payment of the bond as well as it current market price assuming bond is held … What is the difference between Coupon Rate and Yield of Maturity? A bond's yield is the annual interest payment it makes as a proportion of its market value. Although it may appear to be the same as the coupon rate, it is not. The yield would fluctuate inversely with the bond's market price. Yield formula. Let consider three scenarios. Scenario -1. Coupon rate = (10000 * 10) / 100 = 1000 (Interest Payment ... Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Coupon Rate = Reference Rate + Quoted Margin The quoted margin is the additional amount that the issuer agrees to pay over the reference rate. For example, suppose the reference rate is a 5-year Treasury Yield, and the quoted margin is 0.5%, then the coupon rate would be - Coupon Rate = 5-Year Treasury Yield + .05% Coupon Rate Formula | Step by Step Calculation (with Examples) Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100 Therefore, the coupon rate of the bond can be calculated using the above formula as, Coupon Rate of the Bond will be - Therefore, Dave is correct.

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion Bond Coupon Interest Rate: How It Affects Price - Investopedia Say that a $1,000 face value bond has a coupon interest rate of 5%. No matter what happens to the bond's price, the bondholder receives $50 that year from the issuer. However, if the bond price... Coupon Rate Formula | Simple-Accounting.org The coupon rate, or coupon payment, is the yield the bond paid on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to maturity. The prevailing interest rate directly affects the coupon rate of a bond, as well as its market price.Therefore, if a $1,000 bond with a 6% coupon rate sells for $1,000 ... Of coupons, yields, rates and spreads: What does it all mean? Key takeaways. A coupon is a fixed cash payment the investor is promised on a bond, usually expressed as a percent of the par value - which is also known as the principal.; Yield and rate of return are both dynamic values that describe the performance of a bond over a set period of time. While the rate of return on an investment is the percentage increase over the initial investment cost, a ...

Bond Yield Rate vs. Coupon Rate: What's the Difference? A bond's coupon rate is the rate of interest it pays annually, while its yield is the rate of return it generates. A bond's coupon rate is expressed as a percentage of its par value. The par value...

Coupon Rate Calculator | Bond Coupon The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%.

Bond Yield Formula | Step by Step Calculation & Examples Suppose a bond has a face value of $1300. And the interest promised to pay (coupon rated) is 6%. Find the bond yield if the bond price is $1600. Face Value = $1300; Coupon Rate = 6%; Bond Price = $1600; Solution: Here we have to understand that this calculation completely depends on annual coupon and bond price.

Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. 1. Overview and Key Difference.

Coupon Rate vs Interest Rate | Top 8 Best Differences (with Infographics) Difference Between Coupon Rate vs Interest Rate. A coupon rate refers to the rate which is calculated on face value of the bond i.e., it is yield on the fixed income security that is largely impacted by the government set interest rates and it is usually decided by the issuer of the bonds whereas interest rate refers to the rate which is charged to borrower by lender, decided by the lender and ...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

When is a bond's coupon rate and yield to maturity the same? The coupon rate is often different from the yield. A bond's yield is more accurately thought of as the effective rate of return based on the actual market value of the bond. At face value, the...

Coupon Rate: Formula and Bond Nominal Yield Calculator The coupon rate, or "nominal yield," is the rate of interest paid to a bondholder by the issuer of the debt. The coupon rate on a bond issuance is used to calculate the dollar amount of coupon payments paid, i.e. the periodic interest payments by the issuer to bondholders.

Post a Comment for "44 coupon rate and yield"