44 duration for zero coupon bond

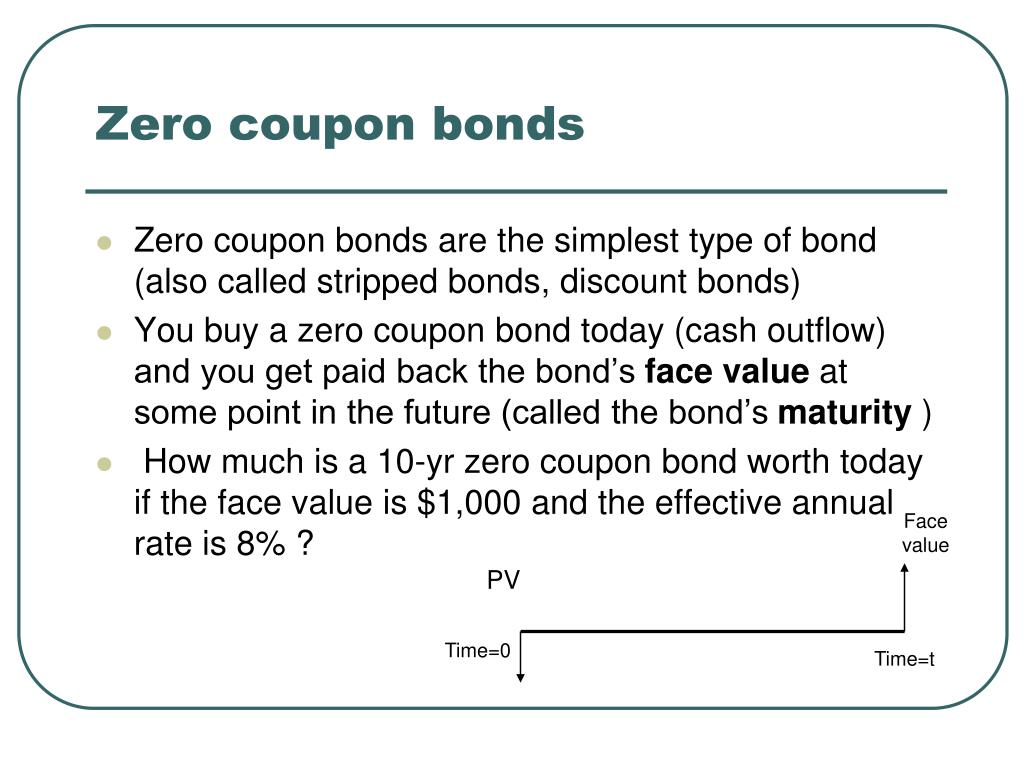

Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond. Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000; Coupon: 5%; Current Trading Price: $960.27; Yield to Maturity: 6.5% ...

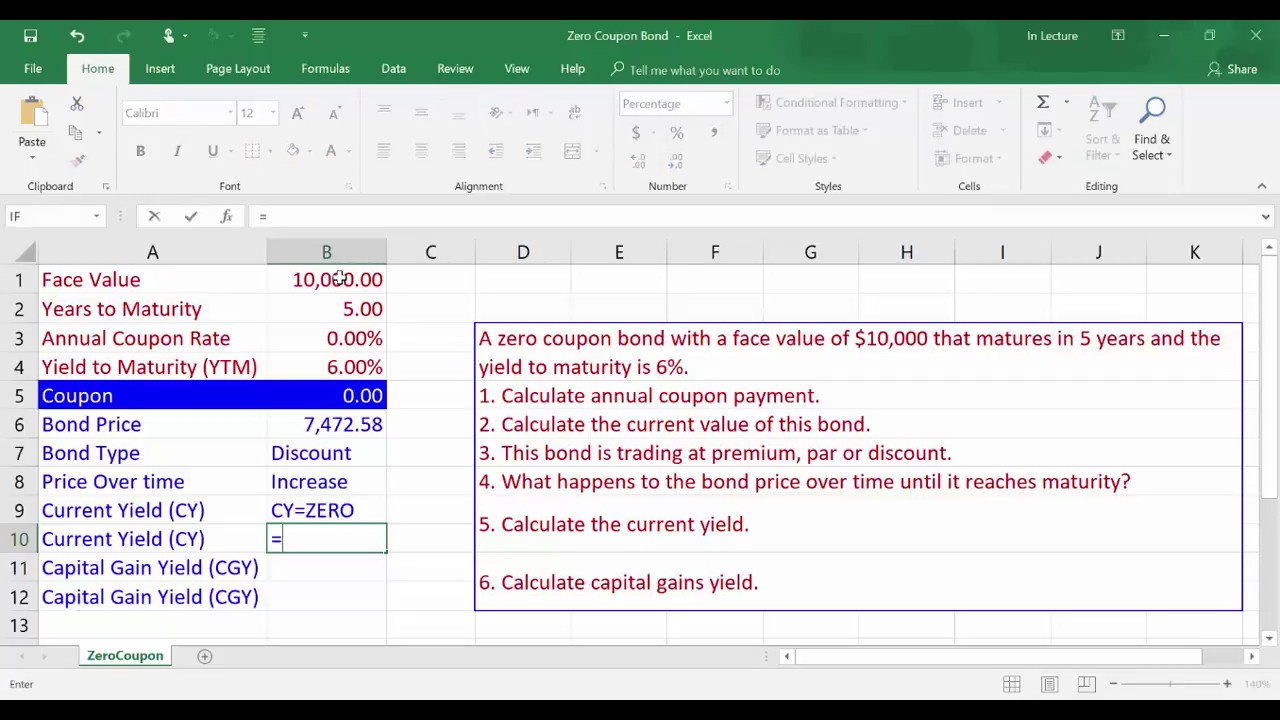

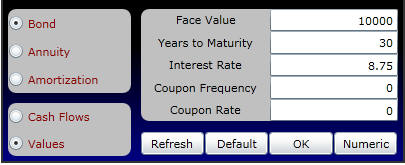

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel. Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and B, right-click on the columns, select "Column Width", and change the value to 30 for both columns. Next, enter "Par Value" into cell A2 ...

Duration for zero coupon bond

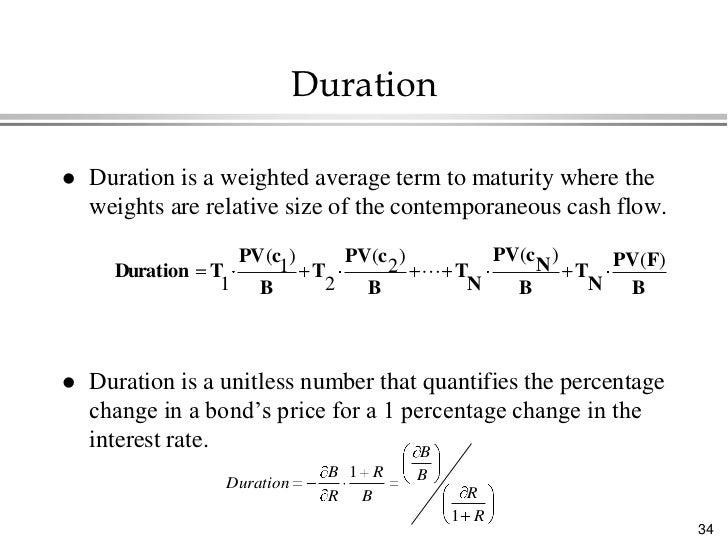

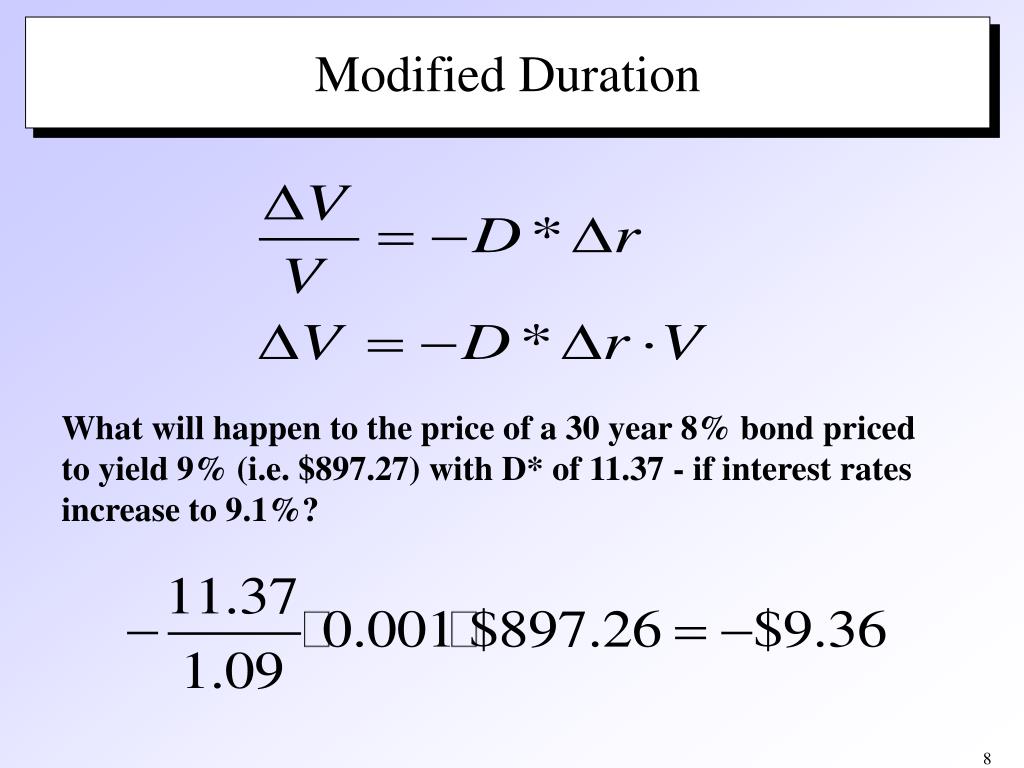

fixed income - Duration of callable zero coupon bond - Quantitative ... What is the bond duration? A- 10 Years B- 5 Years C- 7.5 Years D- Cannot be determined based on the data given. According to me it should be 10 years as the duration of a zero coupon bond is always equal to its maturity. But I am not getting convinced with my answer because of the callable feature in the question. duration of zero coupon bonds | Forum | Bionic Turtle With respect to a zero coupon bond, Macaulay duration = maturity, and therefore must be a monotonically increasing function of maturity. On the other hand, DV01 of a zero (or deeply discounted) is not strictly increasing as DV01 = P*D/10,000 and the numerator has offsetting effects. If you'd kindly reference, I can fix? Thanks! Apr 7, 2012 #3 S Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

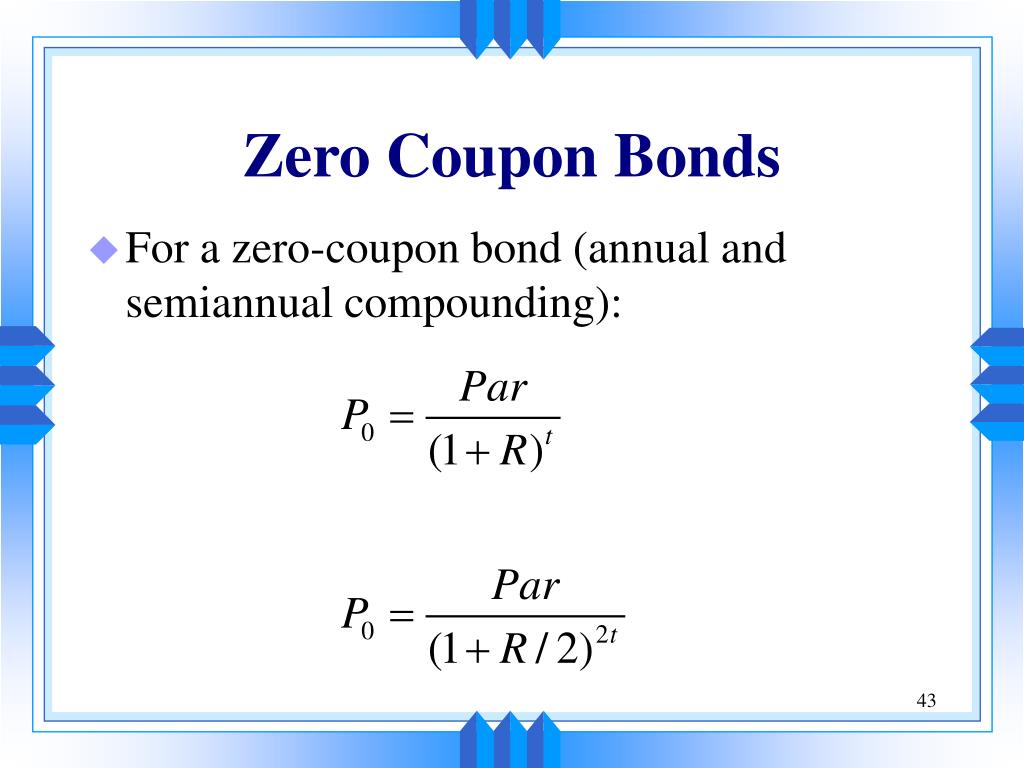

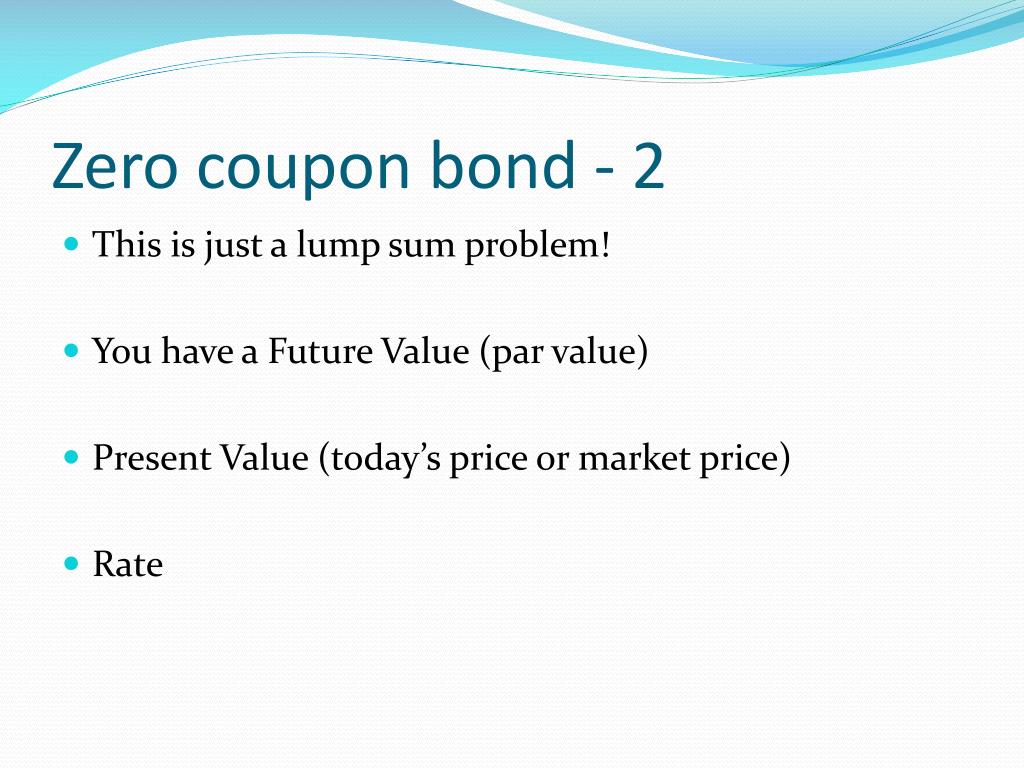

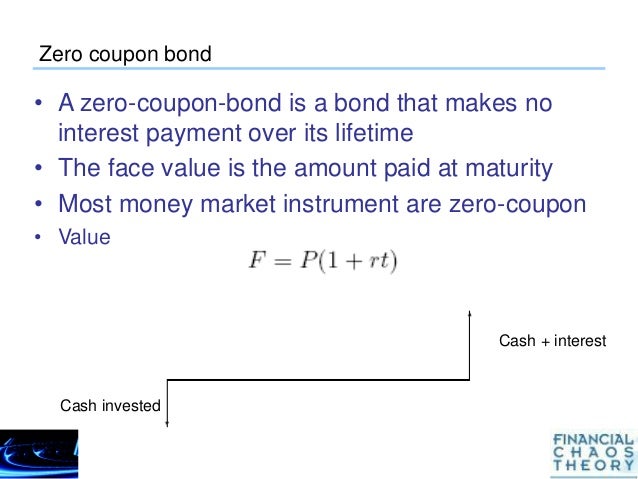

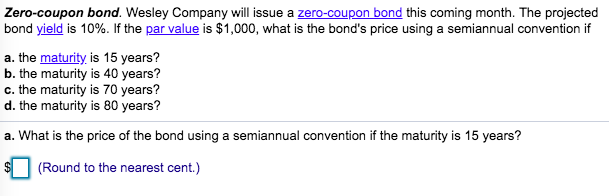

Duration for zero coupon bond. What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N... What is the duration of a zero coupon bond? - Quora Originally Answered: what is the duration of a zero coupon bond? Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Zero-coupon bond - Wikipedia Zero coupon bonds may be long or short-term investments. Long-term zero coupon maturity dates typically start at ten to fifteen years. The bonds can be held until maturity or sold on secondary bond markets. Short-term zero coupon bonds generally have maturities of less than one year and are called bills.

Calculate duration of zero coupon bond - Stack Exchange Let Pz (t, T ) be the price of a zero coupon bond at time t with maturity T and continuously compounded interest rate r. Duration = − 1 P d P d r Let A and a be two constants and x be a variable. Let F ( x) = A × e a x be a function of x. Then, the first derivative of F with respect to x, denoted by d F d x, is given by etfdb.com › etfs › bond-durationShort-Term ETF List Short-Term and all other bond durations are ranked based on their aggregate 3-month fund flows for all U.S.-listed bond ETFs that are classified by ETF Database as being mostly exposed to those respective bond durations. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Short-Term relative to ... Macaulay's Duration | Formula | Example - XPLAIND.com Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value. Annual coupon is $50 (i.e. 5% of the $1,000) and the maturity value is $1,000. What is a Zero Coupon Bond? Who Should Invest? | Scripbox Zero coupon bonds are fixed income securities that don't pay any interest. At the time of maturity, the investor is paid the face value or par value. These bonds come with 10-15 years maturity. Hence, they trade at a deep discount. The bond pricing varies with time to maturity.

› fixed-income-bonds › durationDuration: Understanding the Relationship Between Bond Prices ... Duration is expressed in terms of years, but it is not the same thing as a bond's maturity date. That said, the maturity date of a bond is one of the key components in figuring duration, as is the bond's coupon rate. In the case of a zero-coupon bond, the bond's remaining time to its maturity date is equal to its duration. › dictionary › dWhat Is Duration of a Bond? - TheStreet Definition - TheStreet Mar 22, 2022 · The easiest duration to calculate is that of a zero-coupon bond. This bond has zero yield, which means it does not pay any interest. Its duration is equal to its time to maturity. When a coupon is ... Solved What will be the duration of a zero coupon bond | Chegg.com Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. 100% (1 rating) ANSWER - Duration of Zero coupon bond (ZCB) is the maturity time of the bond is 5 years. Basically duration of the bond is the time at which the payments received …. View the full answer. What is the duration of a zero-coupon bond that has eight years? What ... Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the...

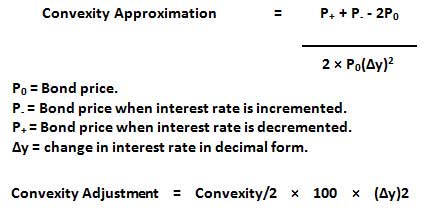

PDF Understanding Duration - BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of

Macaulay Duration - Overview, How To Calculate, Factors A zero-coupon bond assumes the highest Macaulay duration compared with coupon bonds, assuming other features are the same. It is equal to the maturity for a zero-coupon bond and is less than the maturity for coupon bonds. Macaulay duration also demonstrates an inverse relationship with yield to maturity.

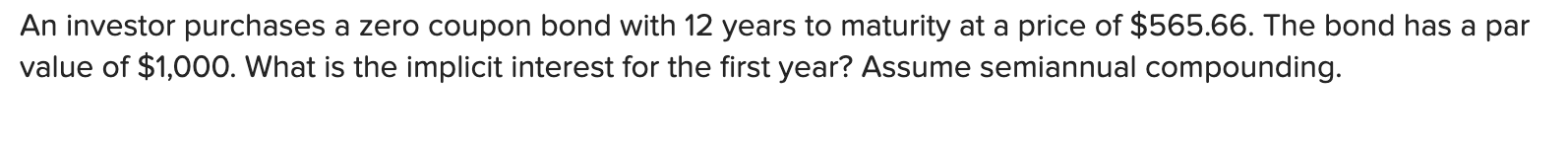

dqydj.com › bond-yield-to-maturity-calculatorBond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity of Zero Coupon Bonds. A zero coupon bond is a bond which doesn't pay periodic payments, instead having only a face value (value at maturity) and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward:

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

How Do Zero Coupon Bonds Work? - SmartAsset A zero coupon bond doesn't pay interest, but it could pay off for your portfolio. Choosing between the many different types of bonds may require a plan for your broader investments. A zero coupon bond often requires less money up front than other bonds. Yet zero coupon bonds still carry some of risk and can still be influenced by interest rates.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond.

Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years.

Zero Duration ETF List - ETFdb.com Zero Duration and all other bond durations are ranked based on their aggregate 3-month fund flows for all U.S.-listed bond ETFs that are classified by ETF Database as being mostly exposed to those respective bond durations. 3-month fund flows is a metric that can be used to gauge the perceived popularity amongst investors of Zero Duration ...

› terms › dDuration Definition - Investopedia Nov 11, 2021 · Duration is a measure of the sensitivity of the price -- the value of principal -- of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years. Bond ...

Zero-Coupon Bond: Formula and Excel Calculator Generally, zero-coupon bonds have maturities of around 10+ years, which is why a substantial portion of the investor base has longer-term expected holding periods.

The Macaulay Duration of a Zero-Coupon Bond in Excel Calculating the Macauley Duration in Excel Assume you hold a two-year zero-coupon bond with a par value of $10,000, a yield of 5%, and you want to calculate the duration in Excel. In columns A and...

Post a Comment for "44 duration for zero coupon bond"